)

MANAGING REAL ESTATE AS INFLATION AND INTEREST RATES RISE

As both an Owner and Lender in the Real Estate industry, TDA continues to adapt to the evolving market. Inflation has pushed real estate costs and rents to new highs, while interest rate headwinds have slowed the capability of many buyers/borrowers in the market. Appraised values of income-generating properties in certain sectors have slowly returned to pre-pandemic levels, while other property types continue to face challenges. As owners, TDA continues to invest in our assets to provide our tenants high-quality market offerings. As lenders, we are still actively pursuing new financing opportunities, even as traditional banks retrench.

LENDING

TDA’s loan portfolio is always changing. During the quarter, additional capital was allocated and reserved for multiple new construction and flexible bridge loans. While most asset classes are of interest, we have a focus on construction and bridge financing in the industrial, multifamily and creative office space, even as other market lenders pull back.

SALES

Although generally not an active seller, due to pockets of market strength and buyer appetite for certain asset types, TDA is currently selling some land holdings in Hawaii, a 100%-leased mixed-use building in the Sacramento region, a grocery-anchored asset in an infill Southern California submarket, and a few long-term owned and smaller industrial properties in Southern California. We plan to immediately redeploy these funds into new investments and loans.

LEASING

Maybe surprisingly, but we are experiencing positive absorption and signs of strength across our multiple retail properties. We are rolling over leases to market rates, but also being mindful that relationships with long-term tenants are often more important than maximizing near-term rental rates. TDA is a long-term asset owner and operator and does not seek the highest market terms at any cost. At one of our alternative real estate holdings, we are continuing to expand our Palomar Airport tenant operations for this growing market.

DEVELOPMENT

Construction at the Canyon Springs Medical Campus, and a Hollywood Multifamily project, is well underway. A potential Riverside industrial development on land which has been owned for decades is also being evaluated.

LENDING ACTIVITY

1714 Franklin – Office

In March 2022, TDA closed a $13 million Senior Bridge Loan on a 3-story brick & timber creative office building in the Uptown area of Oakland, CA, a transit and amenity-rich location. Even in an uncertain office marketplace we were eager to provide this financing on a high-quality asset with a borrower with whom we have worked in the past.

200 Mesnager – Multifamily

In late 2021 TDA closed a $49 million Mezzanine Construction Loan for a 280-unit mixed use multifamily development in the Chinatown district of Los Angeles. In conjunction with TDA financing, an $80 million Senior Loan from an insurance company closed simultaneously. The borrower/developer is building this project as a long-term core holding for their portfolio. We look forward to engaging in additional projects with them when appropriate.

Koloa Village – Retail

TDA was repaid on a $28 million construction loan facility in the second quarter of 2022. A local Hawaii Bank and its co-lending partner provided the permanent financing for the owner. TDA had been involved in this mixed-use project in Kauai, Hawaii since 2018, originally as a lender to execute site and infrastructure activities and then to actually construct the buildings. TDA has the capability to be involved at various stages of a project’s evolution.

SALES ACTIVITY

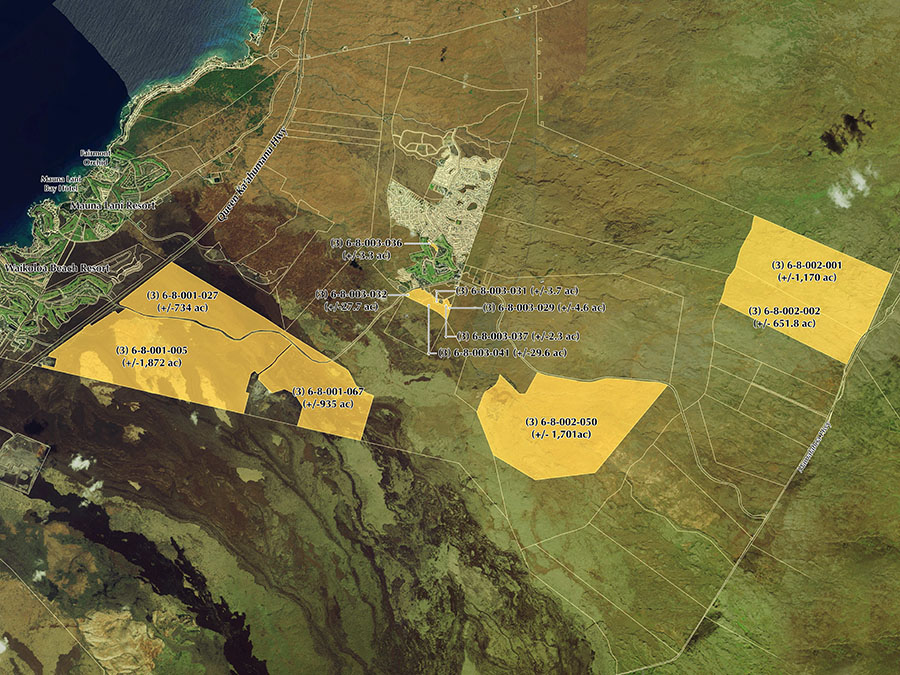

Waikoloa, Hawaii – Land

Multiple land parcels were sold across our significant ~7,000 acres of a mixed-use property on the Big Island of Hawaii. We dealt with multiple unrelated parties on various transactions in recent quarters, with more to occur in the future. We also are ground leasing some of these land holdings to a solar developer who is midway through construction of a world-class utility scale solar project on one of our owned properties.

Iowa Corporate Center – Industrial

In January 2022 we finalized a $17 million sale of another long-term asset from our portfolio. While the property served us well for multiple decades, the buyer has other plans to add value over time. This was a win-win circumstance for both TDA and the new owner.

Chino Hills – Retail

Our Chino Hills Property was a 22,000 square foot single-tenant retail parcel, fully occupied by Grocery Outlet. In the prior eighteen months TDA repositioned this asset by executing a lease with Grocery Outlet, we then decided to sell this net leased property to the market during the first half of 2022.

LEASING ACTIVITY

Carlsbad Jet Center, McClellan Palomar Airport

TDA has been involved with this non-traditional real estate investment (aviation infrastructure) for nearly two decades. As the industry had expanded in recent years TDA undertook a significant capital investment program at its FBO at Carlsbad Jet Center, McClellan Palomar Airport. In recent times an executive terminal was completed, multiple buildings underwent roof and internal systems upgrades, and the quality level was generally upgraded to meet and exceed customer expectations. Owned portfolio assets like CJC get the same care and strategic review as any of TDA’s new investment undertakings.

Canyon Springs Marketplace – Retail

TDA executed the development of this nearly 200,000sf retail development over fifteen years ago. Various market cycles have come and gone. As Covid nears its end, the first half of 2022 was active in re-tenanting this project. A long-term lease was executed with Nordstrom Rack, a space formerly occupied by Bed Bath and Beyond. Other significant new leases or re-leases are in the works into the latter part of the year.

DEVELOPMENT ACTIVITY

Canyon Springs – Medical Office Campus

This Riverside medical office campus/development was years in the making, on land that has been owned for over three decades. Planned for a future hospital, TDA first initiated development of infrastructure improvements over the past couple years, and currently in process is the construction of the first medical office building (MOB). This all-equity funded MOB is nearing completion in late 2022. Some leases are signed and discussions are in place for the balance of this 75,000sf building. Despite the difficult market environment during Covid TDA took a strategic perspective in its decision making process. The marketplace needed this product. There was no reason to delay these fundamentally good long-term projects.

Other developments at the campus are in various stages of planning. TDA may be either a direct capital investor in certain of these projects, or is also open to providing novel and flexible ground lease or other structures so that 3rd party developers can more rapidly build out the campus. This total 50-acre master-planned development is expected to ultimately include a 280-bed hospital, 400,000 square feet of MOBs, senior housing, skilled nursing, assisted living, parking garages, and other post-acute care facilities totaling over one million square feet.